SMM News on July 19:

Under the influence of frequent "unexpected events" in both macro and fundamental aspects, aluminum prices fluctuated more severely in the first half of 2025.

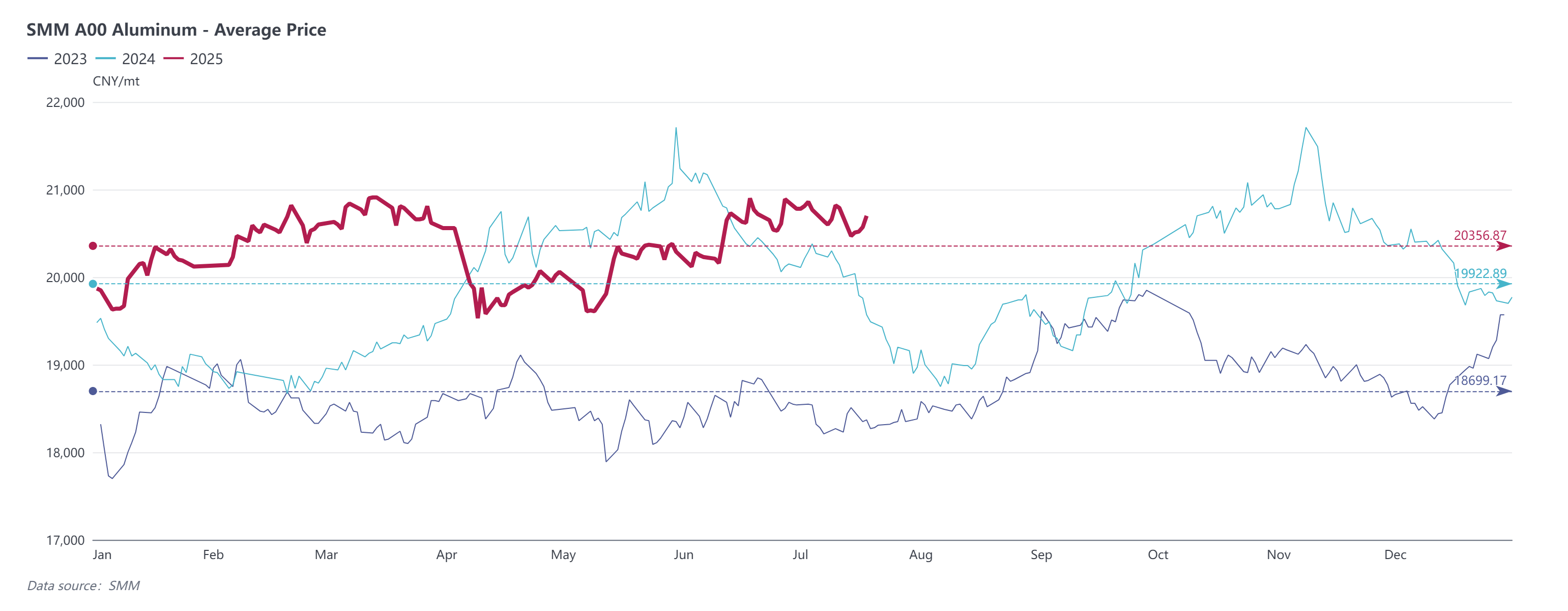

In Q1, the domestic fundamental situation was better than the off-season performance in previous years, providing support for aluminum futures and spot prices. In Q2, the Sino-US tariff battle intensified, causing aluminum futures and spot prices to plummet. However, upon reviewing the trend, it can be seen that after the market sentiment was digested, aluminum prices rebounded rapidly, demonstrating resilience. Additionally, the social inventory of aluminum ingots in the off-season from May to June decreased unexpectedly, leading aluminum futures and spot prices to rise strongly during the off-season, with outstanding performance. Overall, the center of aluminum prices in H1 2025 showed a trend of oscillating upward. The average spot aluminum price in H1 2025 was around 20,318 yuan/mt, up 2.6% from H1 2024.

Review of Major Events in H1 2025:

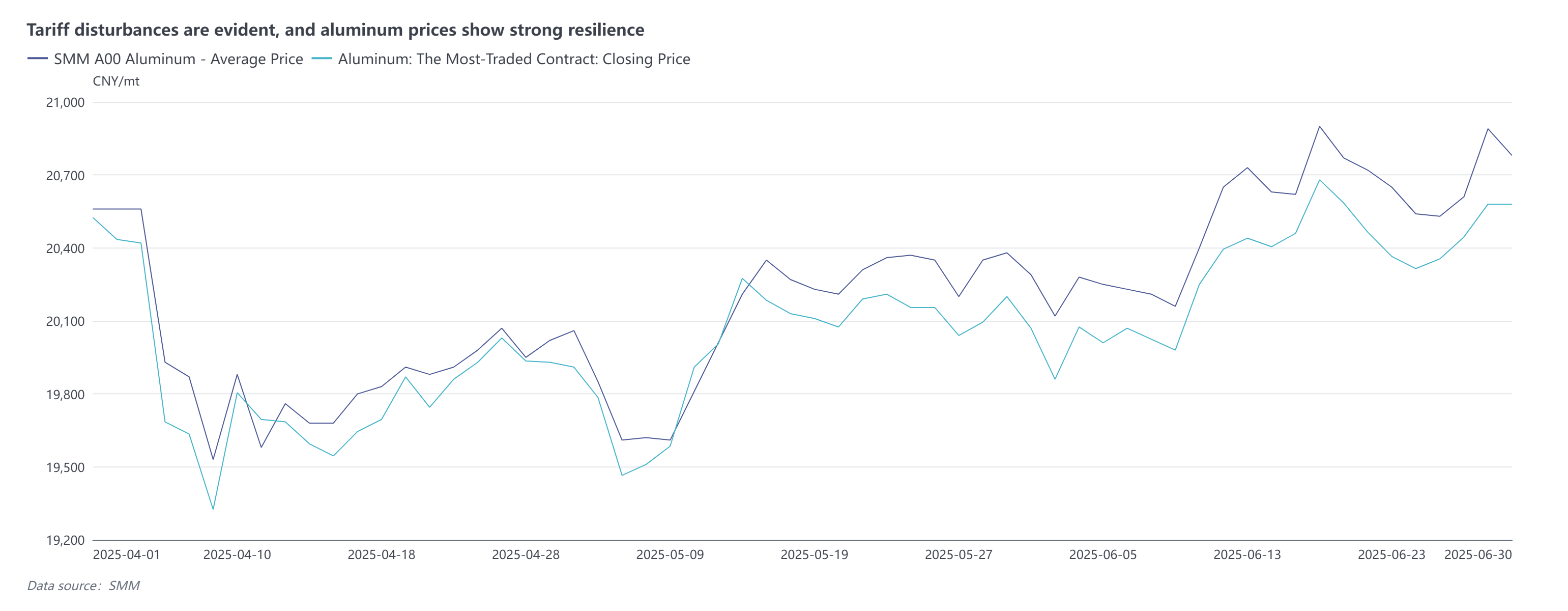

1. Trade War Escalation: Tariff War Disrupts Significantly, Aluminum Prices Remain Resilient

On April 3, the US announced a 10% "minimum benchmark tariff" for all trading partners and imposed higher tariffs on multiple trading partners. Among them, China was subject to a 34% tariff hike. China announced a 34% tariff hike on all imported goods originating from the US to safeguard its sovereignty, security, and development interests. Subsequently, both China and the US continued to impose additional tariffs on each other, with Sino-US trade almost decoupling. Until the Sino-US high-level economic and trade talks were held from May 10-11, it was indicated that multiple consensus had been reached between China and the US, and a 90-day window period was set. Currently, the window period has passed in early July, but no new policies have been introduced yet, and market attention remains high.

From the perspective of price trends, aluminum futures plummeted at the opening on April 7, hitting the daily limit, but domestic fundamentals provided strong support, and aluminum prices soon showed a trend of rebounding slightly, demonstrating strong resilience. Moreover, with the subsequent operation of the window period, domestic "rush to export" stimulated demand growth, and the center of aluminum prices returned to highs.

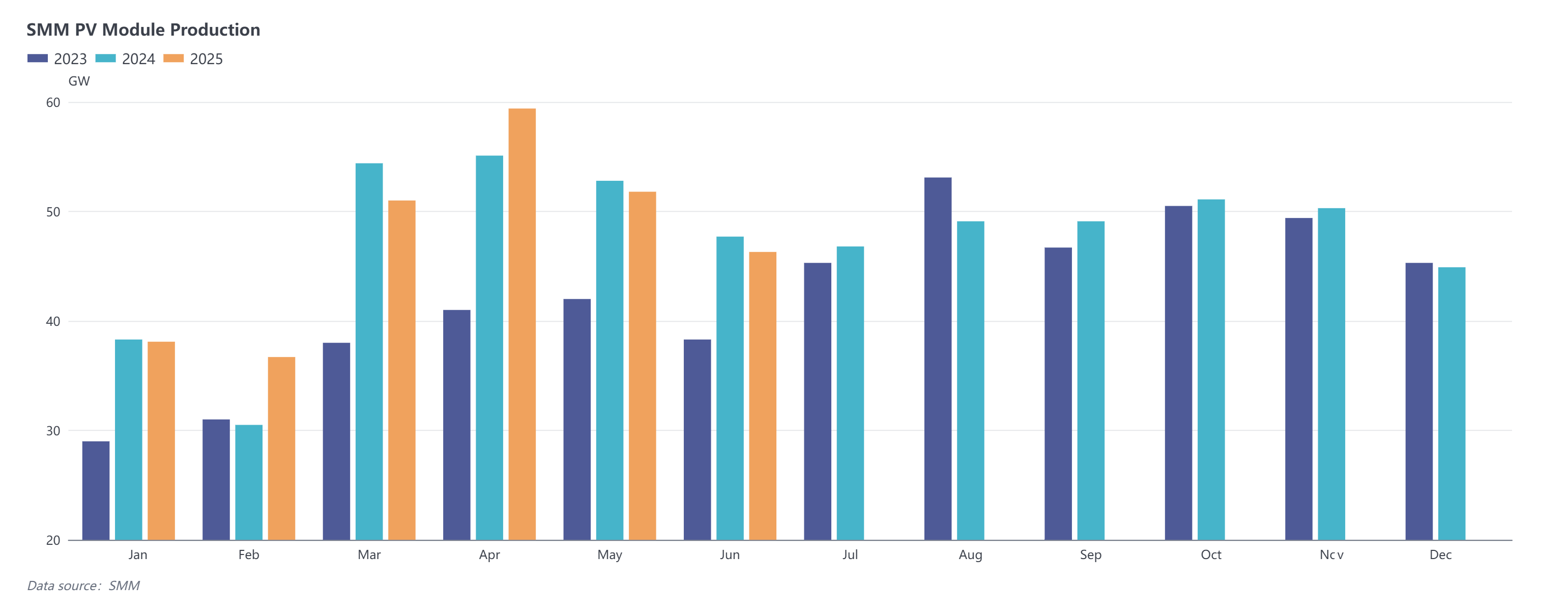

2. Early Release of Future Demand: PV Installation Rush Stimulates Consumption, Aluminum Prices Receive Support

The "430 New Policy" (i.e., the "Administrative Measures for the Development and Construction of Distributed PV Power Generation") and the "531 New Policy" (i.e., the "Notice on Deepening the Market-Oriented Reform of On-Grid Tariffs for New Energy to Promote High-Quality Development of New Energy") announced in H1 2025 led to a rush in distributed PV installations. In recent years, aluminum used in PV has become one of the main supporting sectors for aluminum demand. The operating rates of related aluminum semis processing enterprises have fluctuated at highs, but there has been a serious "imbalance between quantity and price," with processing fees for PV frames continuously decreasing, and loss-making operations becoming widespread.

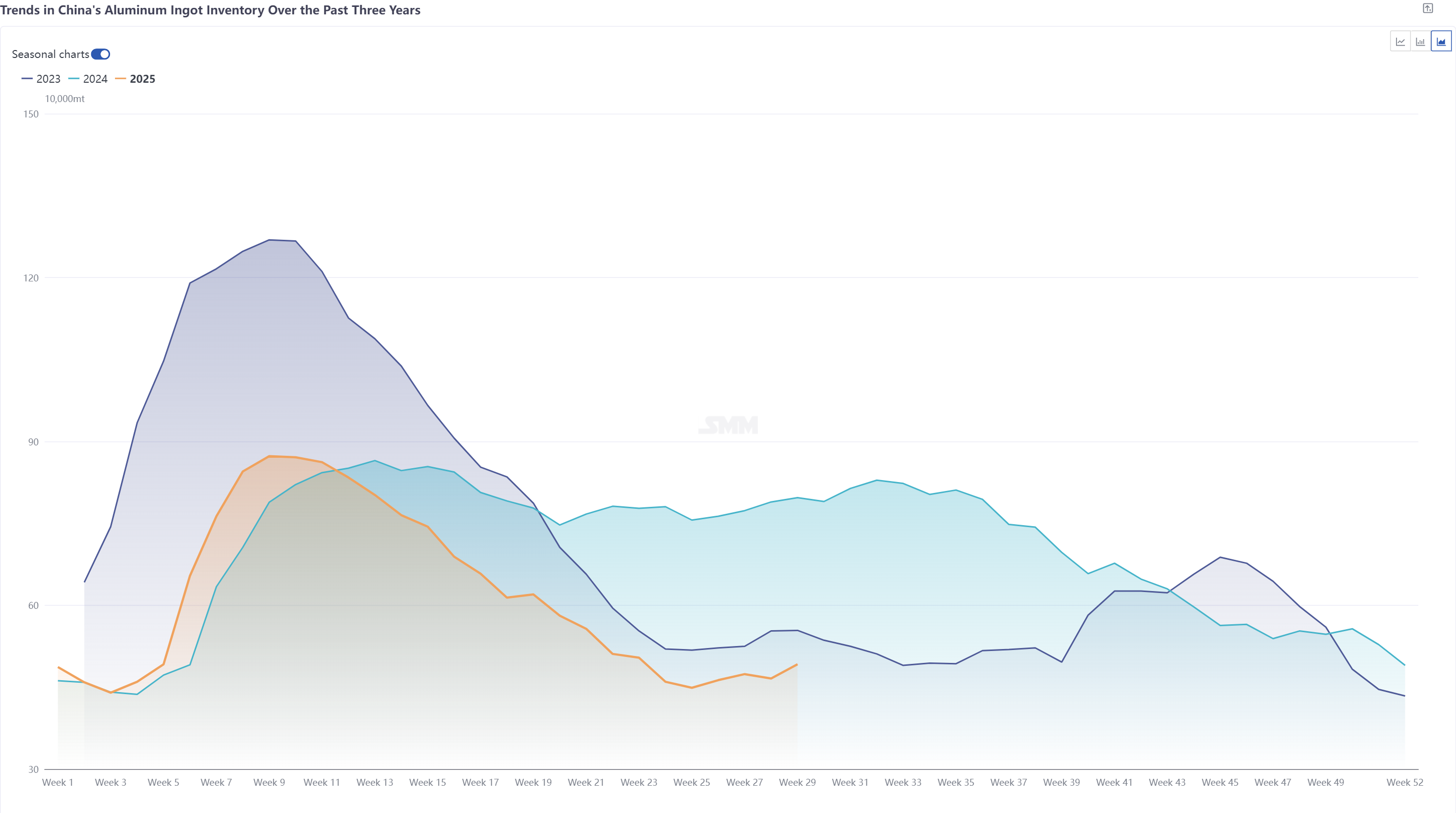

3. Low Inventory: Social Inventory of Aluminum Ingot Declines More Than Expected, Aluminum Prices Strengthen During Off-Season

From mid-May to early June, domestic aluminum ingot inventory declined more than expected, with inventory levels continuously hitting new lows in Q2 and even falling below the 450,000 mt threshold at one point. Despite the high aluminum prices suppressing downstream restocking willingness and market expectations that the approaching off-season would slow down destocking, the actual destocking trend continued until the end of June, with aluminum demand resilience exceeding expectations. The core drivers of destocking were the continued tight supply on the supply side, with aluminum smelters in multiple northern regions and some electrolytic aluminum smelters in the southwest rapidly increasing the proportion of liquid aluminum, while casting ingot volumes declined MoM. Coupled with the consistently low in-transit and actual arrival volumes in mainstream consumption areas, the social inventory of aluminum ingot exceeded expectations under the tight supply background, providing favorable support for aluminum prices to strengthen during the off-season.

Overall, in H1 2025, influenced by macro headwinds, aluminum prices faced periodic downward pressure. However, factors such as stable supply on the fundamentals side, coupled with early release of future demand from downstream and low aluminum ingot inventory, created a generally positive atmosphere, providing strong support for aluminum prices, with the price center oscillating and rising.

Outlook for H2 2025:

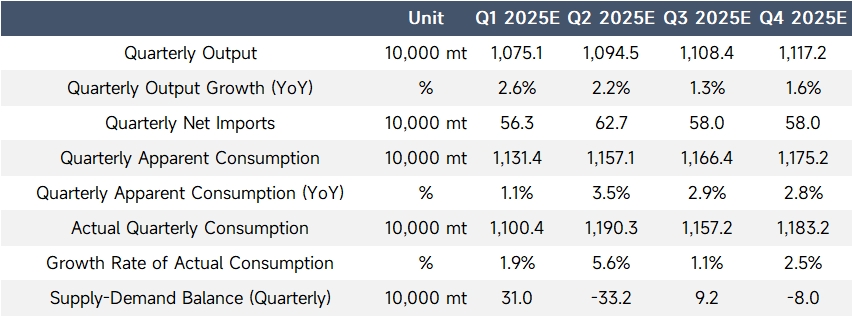

Entering the second half of 2025, overseas macro disturbance risks still persist, and the follow-up to the Sino-US trade war still needs to be tracked. Attention has also shifted to expectations for US Fed interest rate cuts. Domestically, the favourable macro front and the atmosphere of promoting consumption remain unchanged, while "anti-rat race" competition may cause short-term fluctuations in end-use demand. On the fundamentals side, the supply side is expected to operate steadily in the second half of the year, with no new domestic projects expected to come online. Except for the replacement projects between Shandong and Yunnan, the capacity replacement projects between Henan and Inner Mongolia are expected to start up sequentially in Q4. Considering the relatively small impact of project replacement on electrolytic aluminum production, the YoY growth rate of production in the second half of the year is expected to be 0.9%, and the annual production growth rate is expected to be around 1.9%. In terms of net imports, the current import window remains closed, with imported supplies mainly executing long-term contracts. Subsequently, with the arrival of the domestic peak season and the impact of weak overseas demand, net imports are expected to increase slightly, with the annual net import growth rate expected to be around 17%. On the demand side, downstream demand remains weak. Considering the early release of future demand from PV installation rush and rush to export of aluminum semis in H1 2025, the actual consumption growth rate in the second half of the year is expected to fall to around 2.7% from 3.9% in the first half of the year. In addition, it is worth noting that during the current domestic off-season, alloy product enterprises such as aluminum billet producers are cutting production at a loss, leading to an increase in casting ingot volumes. However, with the arrival of the September-October peak season and the commissioning of new alloy production capacity, the proportion of liquid aluminum will rise again, providing good support for aluminum prices.